These companies must have foreign employees living in Malaysia to work for the entitled company. Or Parents who accompany a child studying in.

Cukai Pendapatan How To File Income Tax In Malaysia

15 times monthly gross income.

. Foreigners are still buying property in Australia so how can you. Original Malaysia Identity Card Either of the below supporting documents to verify mailing address in-1 Singapore 2 Home country. NRI recent updates immigration rues latest visa announcements visa process visa fees visa new rules work visa requirements visa policies NRI investment options Non resident Indian latest news and more on The Economic Times.

Any foreigners who have been working in Malaysia for more than 182 days are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian nationals. For this method the Immigration Department of Malaysia states that you must be a professional with outstanding skills in any field. Make sure this fits by entering your model number.

5 times monthly gross income. The amount you can purchase depends on your credit score and income. Utility Bills Income Tax Assessment Statement from a Bank regulated by MAS Statement from any of the statutory boards or government bodiesNote.

Youll need to obtain recommendation from a relevant agency in Malaysia. You must be certified by the relevant agency in Malaysia. The good news is you can apply for.

Frosted handle mirror lustrous. Once you have procured the funds for your home you will want to hire a lawyer. The so-called ghost tax is a minimum 5000 per year levy for property they either fail to occupy or lease out for at least six months of the year.

Eligibility Manufacturing companies hiring foreigners. RM 2000 RM 4000. Malaysian confinement nannies who want to work in the country for up to 16 weeks that starts with the birth of the employers child.

RM500000 tax rebates are given to companies to create a safe living space for the employees and to cover the rents of the accommodation. This is similar to property tax in other countries. RM 1000 RM 5000.

Foreigners can get a loan in Malaysia. According to LHDN foreigners employed in Malaysia must give notice of their chargeability to the Non-Resident Branch or nearest LHDN branch within 2 months of their. Pre-approved Letter of Consent.

The Malaysian capital is becoming increasingly attractive to global businesses because of its large English-speaking workforce easy flight. EPF contribution rate shown in the EPF table does not apply to foreigners registered as EPF members before August 1 1998. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions.

CIMB and HSBC may recognize 100 of rental income while Public Bank and OCBC may only recognize 80. Work Passes Holders of Long-Term Visit Passes issued by ICA Foreigners who are married to a Singaporean or permanent resident. This is determined by the estimated annual rental value of your property and.

And an offshore income of RM10000 per month. More than RM 6000. Foreign income mortgage calculator.

Property Investments Guideline for Foreigners in Malaysia. Malaysia Personal Income Tax Calculator. 1810 Stainless Steel Mini Teaspoon is extremely durable with Ergonomic design easy to use.

Your real estate agent might be able to help you choose a good lawyer that has worked with other foreigners in the past. For the most part foreigners working in Malaysia are divided into two categories. The next step is to apply for a loan.

Youll also need a Certificate of Good Conduct from your country of originYou can get this from the. For foreigners Form KWSP 16B and then registering as an EPF member using Form KWSP 3 and the employer shall obliged to contribute a minimum of RM 500 per month to a foreigners EPF account regardless of how much he earns. With the implementation of the new MPERS private entities can now choose between the existing PERS framework or apply the Malaysian Financial Reporting Standards framework in preparing their financial reports.

Foreigners working in Malaysia are not obligated to contribute to EPF but may opt to do so. This is why at QNE Cloud Payroll HR we have developed a Malaysian Personal Income Tax Calculator and EPF table to save time and calculate taxes in an easier and more efficient way. 14Sustainable Development Goals SDGs Financing Scheme.

Under the recent Budget 2022 Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens and permanent residents starting from the sixth yearThis means that the RPGT rate for property disposals in the 6th year and. Human Resources Immigration. 20 times monthly gross income.

ABDS rates for foreigners buying any residential property were raised to 30 from 20 whilst the rate for entities purchasing any residential property and developers purchasing any residential. Malaysian Private Entities Reporting Standards MPERS This replaces the previous PERS and is in effect from 1 January 2016. Discover how to get FIRB approval qualify for a mortgage and find a conveyancer.

RPGT 2022 Exemptions. Biro Perkhidmatan Angkasa BPA Salary Deduction PGM Salary Transfer to Bank Rakyat. RM 4001 RM 6000.

Malaysia adopts a territorial approach to income tax. Foreigners may consider buying Malaysian properties under the Malaysia My 2nd Home MM2H visa which makes property ownership more affordable for the long-term. Resident stays in Malaysia for more than 182 days in a calendar year.

Latest NRI news today. RHB recognizes only 45 of foreign derived income while Hong Leong considers 100 of it. 25 times monthly gross income.

Standard Chartered Bank may base their calculations on Gross Income while RHB and Maybank may base it on Net Income. SOCSO is a Malaysian based government agency that was founded and tasked with the responsibility of providing social security protections to Malaysian employees under the private sector.

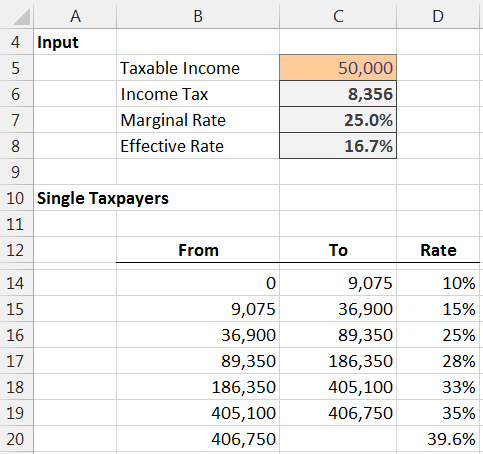

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary Discount 56 Off Www Ingeniovirtual Com

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

How To Calculate Income Tax On Salary Shop 58 Off Www Ingeniovirtual Com

How To Calculate Foreigner S Income Tax In China China Admissions

Individual Income Tax In Malaysia For Expatriates

How To Create An Income Tax Calculator In Excel Youtube

Income Tax Malaysia 2018 Mypf My

How To Calculate Income Tax In Excel

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

How To Calculate Income Tax On Salary Discount 56 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary Shop 58 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

2019 Income Tax Calculator Deals 50 Off Www Ingeniovirtual Com

How To Calculate Tax On Salary Factory Sale 56 Off Www Ingeniovirtual Com

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How To Calculate Income Tax On Salary Discount 56 Off Www Ingeniovirtual Com

- banci penduduk dan perumahan malaysia 2016

- local government act 1976

- giant seksyen 7

- pendaftaran badan sukan

- undefined

- malaysian income tax calculator for foreigners

- rambut keriting pendek perempuan

- kek butter sukatan cawan

- hanya tuhan yang tahu

- status senarai hitam ptptn

- ayat benci untuk tag nama orang

- citizen old klang road price

- epf melaka

- alamat perumahan taman lumut

- harun salim bachik meninggal

- mudah sabah car for sale

- kpj dato onn vacancy

- lonnix (m) sdn bhd

- starbuck buy 1 free 1

- jambu air merah kecil